WELCOME TO

BanKCube™

Company Website

BanKCube™ provides banking solutions and services through three main pillars: Data Services & Solutions, Business Platforms, and Digital Solutions.

BanKCube™ Services & Solutions Pillars

Pillar 1: Data Services & Solutions

Operations Solutions

TReport™ solution - Bank Operations Reporting

BETL™ system - Data ETL and Consolidation System

DocCap™ system - Document Capturing and Archiving System

DSS™ system - Data Masking & Scrambling System

ERS™ Solution - Enterprise Reconciliation System

Services & Tools

- Data Migration Services.

- Data Migration Reconciliation Services.

- Data Cleansing Services.

Pillar 2: Business Platforms

Platforms

DSP™ Platform - Data Services Platform

AOM™ Platform - Asset Operations Management Platform

BAP™ Platform - Business Authorization Platform

EAMS™ Platform - Real estate off-plan operations and Escrow Account Management Platform

BMP™ Platform - Bank Market Place Platform

eCommerce - eCommerce Platform

Pillar 3: Digital Solutions

Solutions

DMS-Digital™ Solution - Documents Generation Solution

TSig™ Solution - Digital Signature capturing Solution

DCO™ Solution - Digital Customer Onboarding Solution

MCA™ solution - Merchant Cash Advance Solution

PMS™ solution - Procurement Management System

RECM™ solution - Real estate Claims Management Solution

RCM™ solution - Returned Cheque Management Solution

DPai™ solution - Advanced AI Document Proofing Solution

SigAI™ solution - Advanced AI Signature Proofing Solution

Collect AI™ solution - Conversational Debt Collection Platform

IDverifyAI™ solution - Intelligent ID & Face Verification Platform

DComAI™ solution - AI Document Comparison Platform

IMS™ solution - Invoicing Management System

Our Partners

Trusted Technology Partners

BanKCube™ Solutions

Data Solutions

1. TReport™ Operational Reporting Solution

A configurable platform for generating on-demand reports from core banking and other data sources, supporting multiple languages. It manages data elements and mappings, offering a broad library of operational templates across all banking business lines.

View Details

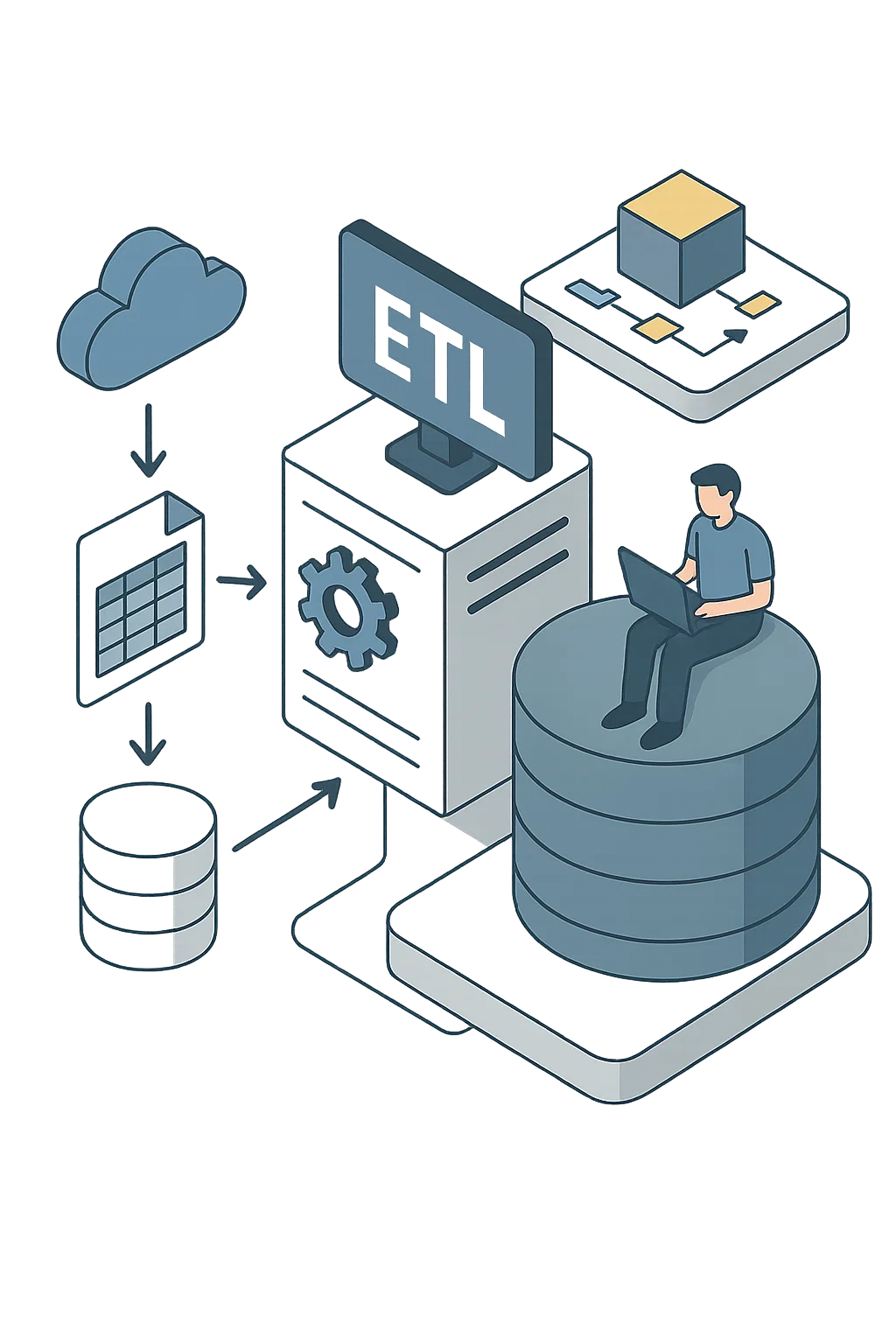

2. BETL™ Data ETL and Consolidation system

A solution that consolidates multiple data sources into a unified data warehouse or big data repository. It requires BanKCube™ services for mapping and applying business rules, ensuring accurate integration and consistent data quality across systems.

View Details

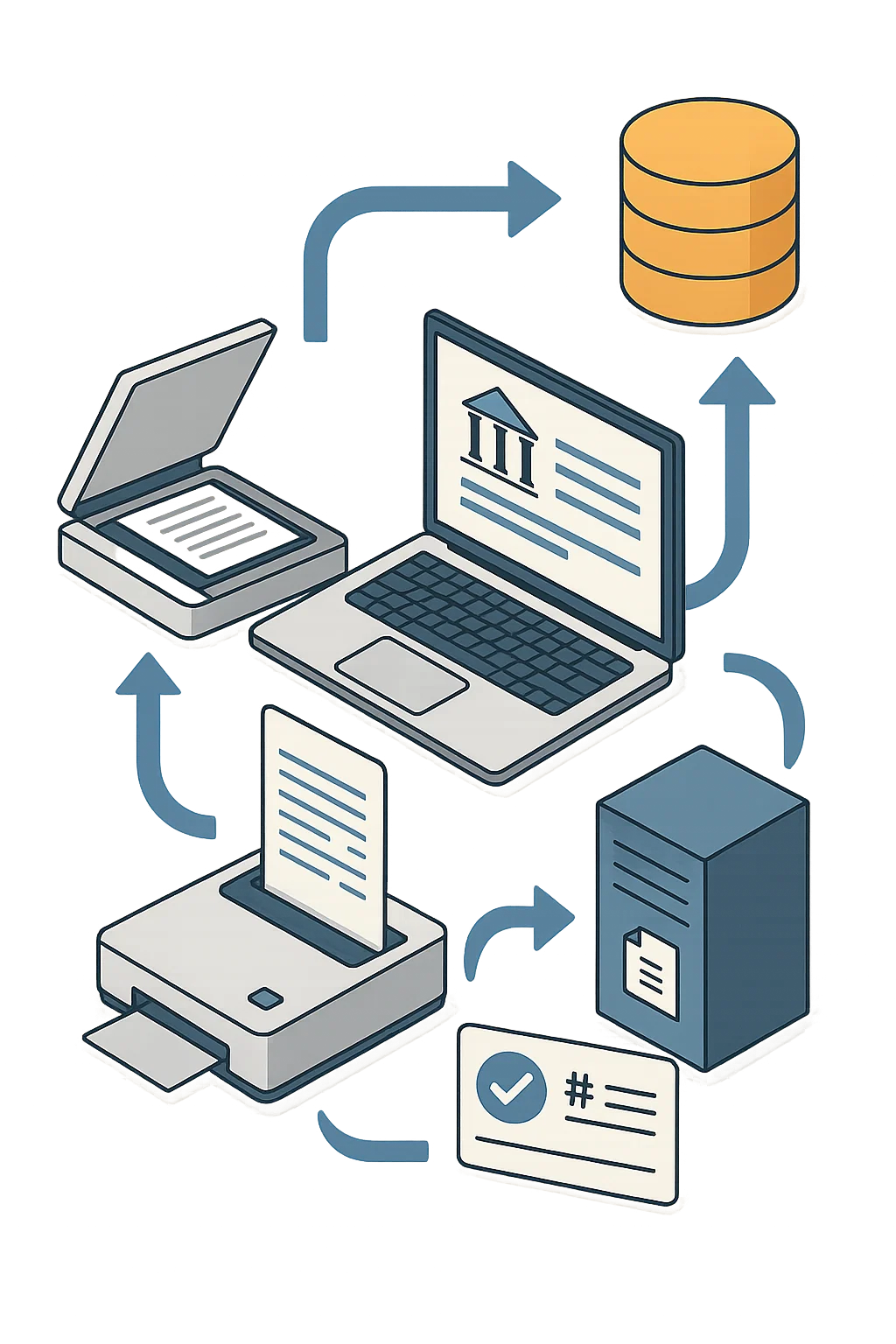

3. DocCap™ Document Capturing and Archiving system

An integrated system that scans and archives documents linked with core banking transactions. DocCap™ captures transaction details, archives related documents, and returns notifications with references, ensuring complete transaction documentation and seamless integration with archiving systems.

View Details

4. DSS™ Data Masking system

A comprehensive platform for securing sensitive customer data in non-production environments. DSS™ uses advanced techniques for masking and scrambling, supporting unlimited systems and database types while maintaining meaningful test data for integration and security compliance.

View Details

5. ERS™ Enterprise Reconciliation Solution

A system reconciling multiple sources and destinations, including core banking, based on business-defined rules. It is a non-stop system 24/7 with predefine scheduler, it generates reconciliation reports and actions, handling Nostro/Vostro accounts, credit cards, cheques, and other instruments through integration with diverse data sources.

View DetailsBusiness Platforms

6. ECommerce eCommerce Solution

BankCube's eCommerce platform connects vendors and customers on a unified digital marketplace, enabling seamless product listing, purchasing, and management. It provides comprehensive tools to streamline transactions, enhance customer engagement, and support integrated financial and banking services.

View Details

7. AOM™ Assets Operations Management Platform

A platform supporting all asset leasing and financing operations, including conventional and Islamic financing. It provides external parties with portals for participation and can integrate with eCommerce platforms and marketplaces to streamline customer financing services.

View Details

8. BAP™ Business Authorization Platform

A flexible authorization platform for handling exceptional business cases such as overdrafts, FX deals, and returned cheques. It supports retail, corporate, and treasury businesses, using the bank's authorization matrix to govern approvals across all processes.

View Details

9. DSP™ Data Services Platform

A platform that delivers instant data services for reports, inquiries, statements, and letters. Fully integrated with core banking, it serves bank users and external channels such as branches, call centers, internet, and mobile banking.

View Details

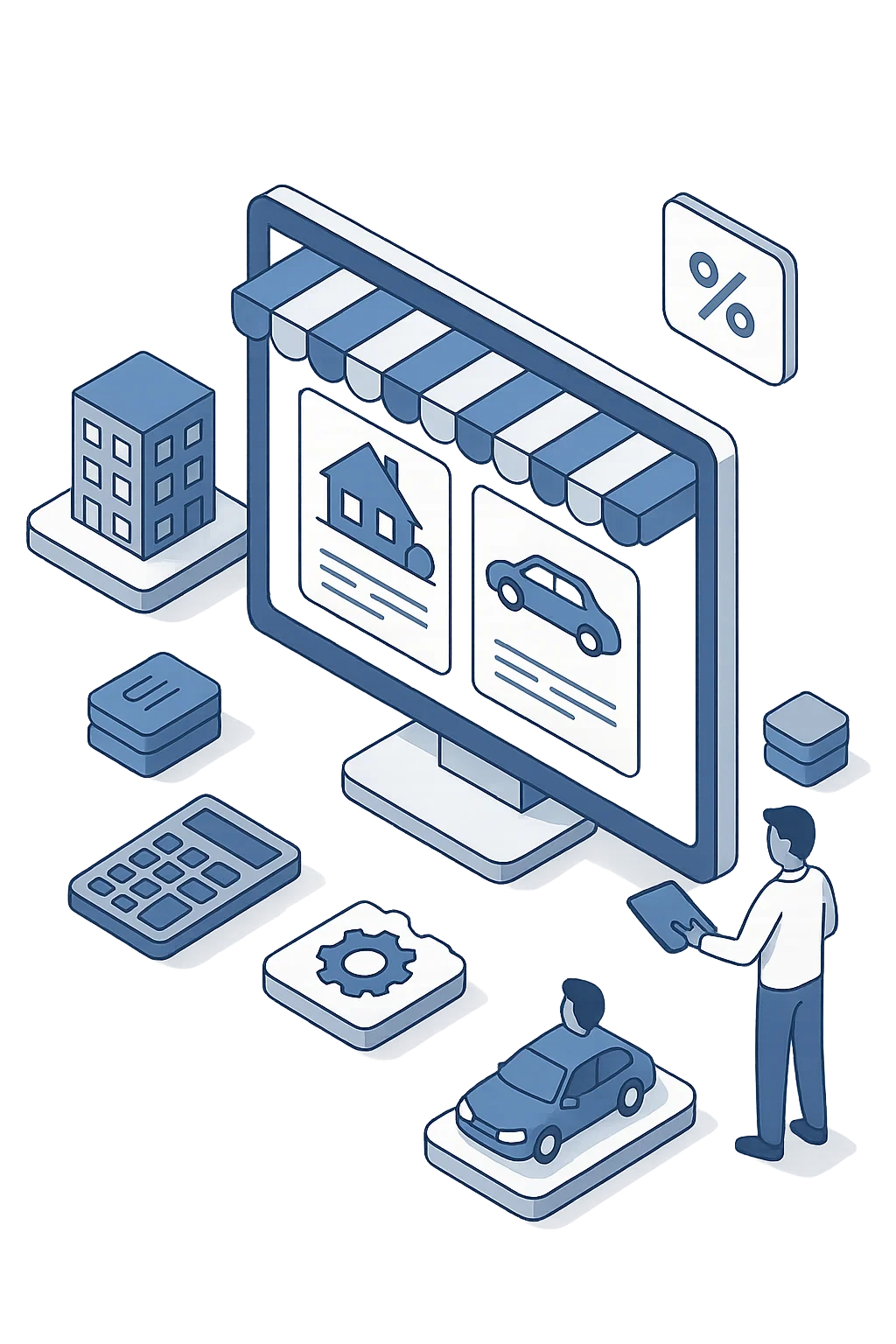

10. BMP™ Bank Market Place

A marketplace platform allowing corporate customers to present asset offers such as real estate or vehicles. It complements these with initial financing offers from the bank, forming part of an integrated digital eCommerce ecosystem.

View DetailsDigital Solutions

11. DMS-Digital™ PDF Documents Generation Solution

A PDF generation solution for statements, letters, contracts, and agreements. It supports document design, scheduling, and multiple data sources, delivering documents for printing, email, or integration with digital banking channels, all fully connected with core banking.

View Details

12. TSig™ Digital Signature Capturing and Trxns Authorization System

A digital signature solution integrated with core banking, ECC, and capture devices. It enables full signature administration, registration, authentication, and authorization, providing secure, device-enabled digital verification for customer transactions and banking processes.

View Details

14. MCA™ Merchant Cash Advance solution

MCA™ provides SMEs with cash advances based on POS devices transaction history. It uses configurable eligibility criteria, repayment parameters, and calculation engines, offering dashboards, reports, and full integration with bank acquiring systems under licensing frameworks.

View Details

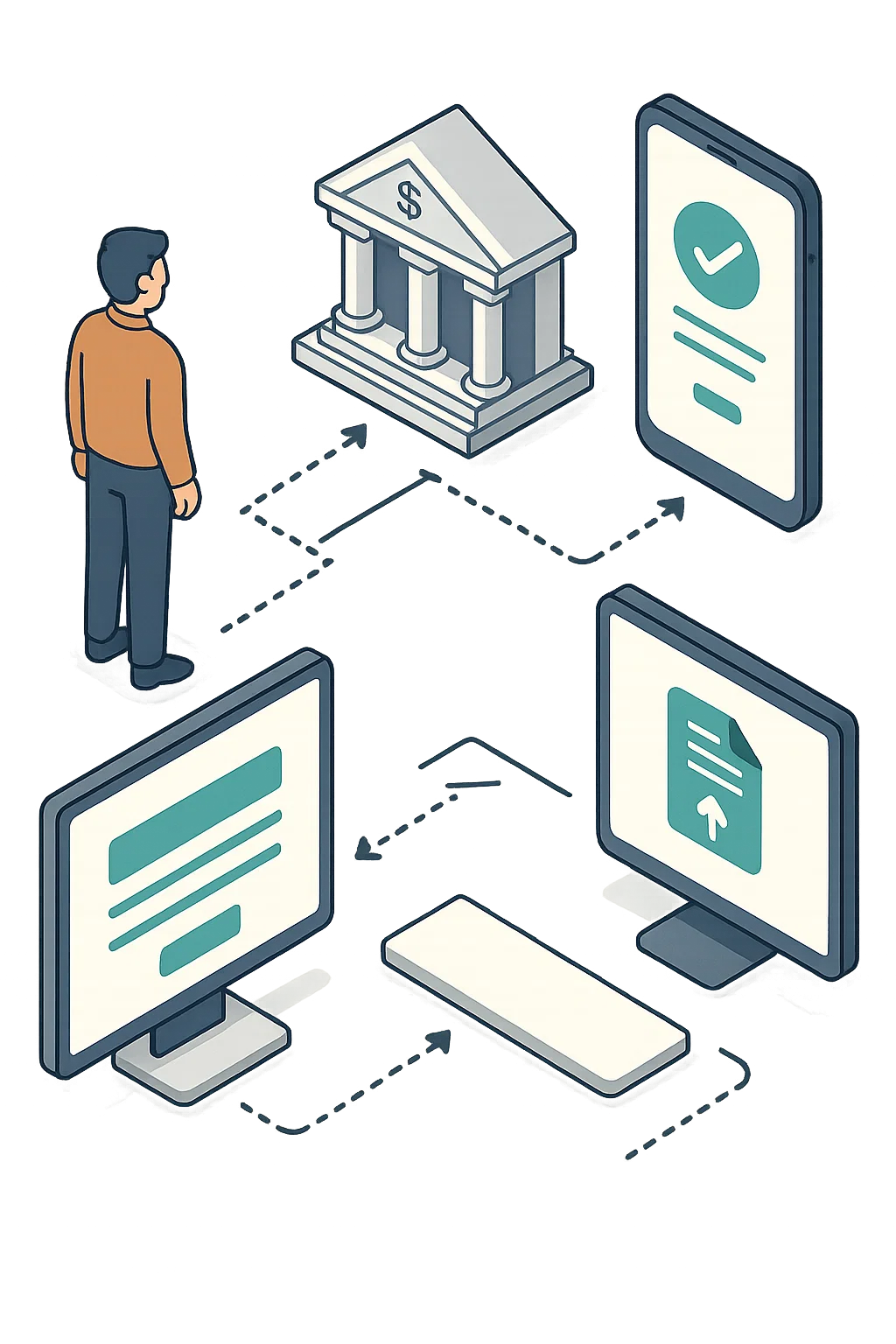

15. DCO™ Digital Customer Onboarding solution

A customer onboarding solution fully integrated with core banking systems, enabling end-to-end customer and account creation. It supports public registration, internal bank operations, application processing, document uploads, and account activation — all streamlined through full process automation.

View Details

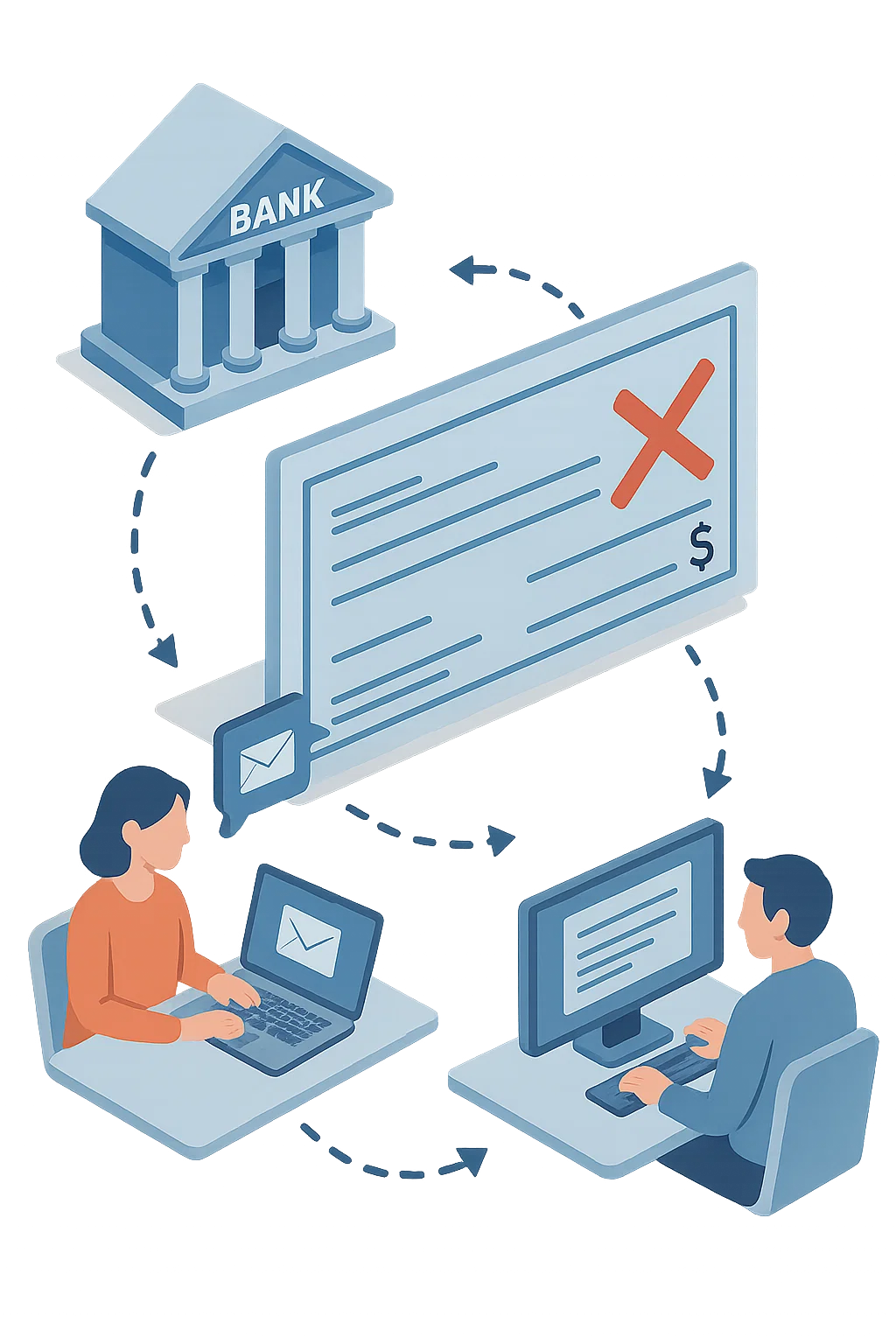

16. RCM™ Returned Cheque Management (RCM™) Solution

A system dedicated to managing returned cheques between banks and customers, streamlining communications, workflows, and reporting to ensure efficient handling of cheque return processes.

View Details

17. PMS™ Procurement Management System solution

A comprehensive procurement solution that manages the entire lifecycle — from requirement gathering and purchase requests to decision-making and purchase orders. It provides an operational portal for bank users and a vendor portal for suppliers, ensuring transparency and efficiency throughout the procurement lifecycle.

View Details

18. IMS™ Invoices Management System

A vendor portal solution automating invoice and payment processes according to bank-defined workflows and approval rules. It streamlines supplier payments while ensuring compliance with organizational policies and authorization hierarchies.

View DetailsAI Solutions

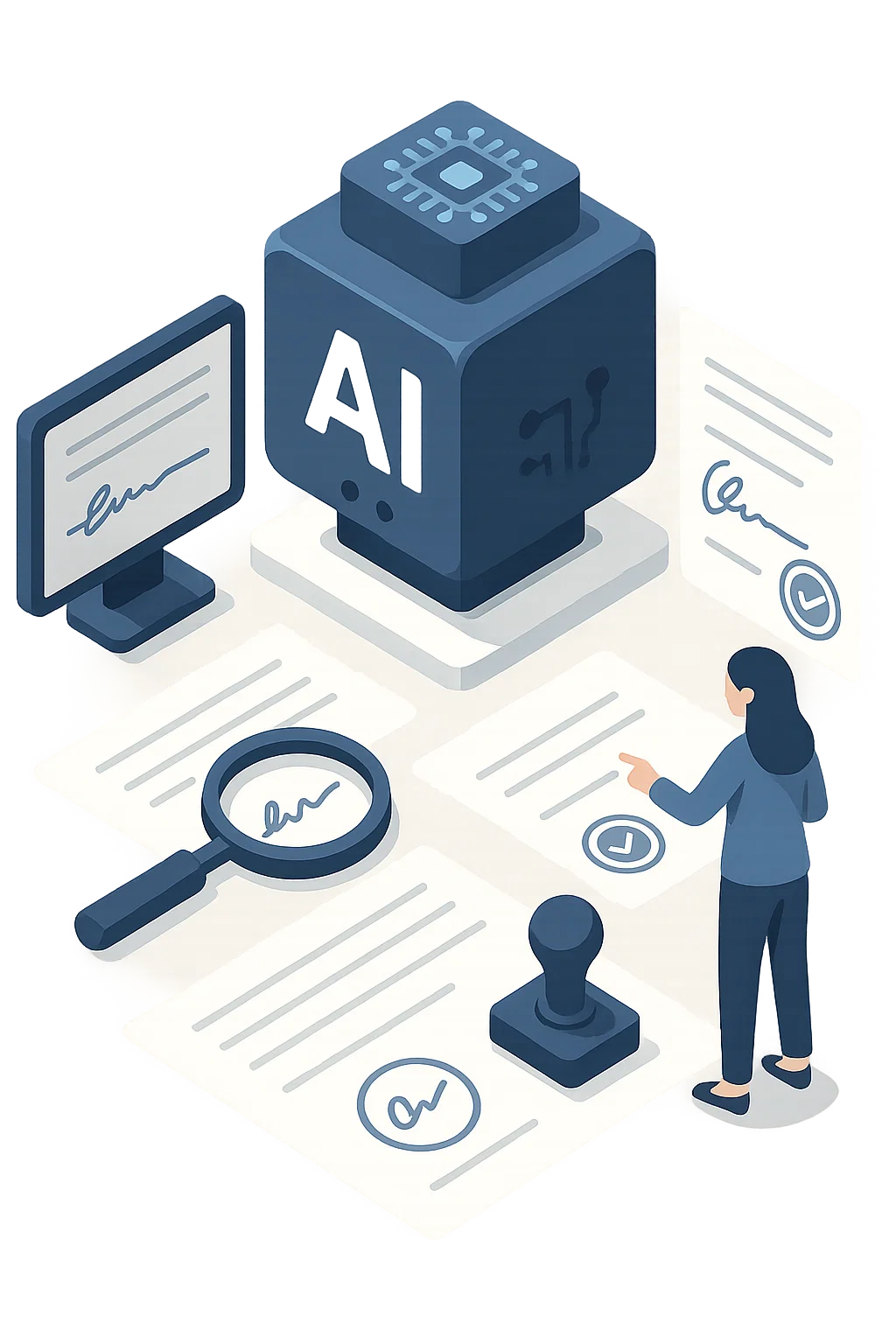

20. DPai™ BankCube™ DocProofAI

DPai™ is an AI-powered proofing solution that automates detection, extraction, and validation of document components like signatures and stamps. It enhances accuracy, accelerates processing, and ensures compliance using Siamese neural networks and advanced machine learning.

View Details

21. SigAI™ AI Signature Verification

A machine learning–based solution for secure signature verification using Siamese neural networks. It differentiates genuine from forged signatures, providing confidence scores and supporting banks with advanced, automated document authentication processes.

View Details

22. Collect AI™ - Conversational Debt Collection Platform

Collect AI™ is an AI-driven collections platform that lets you create, configure, and monitor voice-enabled collection agents. The AI agents automatically call your customers, talk to them in natural, human-like conversations to collect outstanding debts, and from one unified dashboard you can track performance, listen to calls, read transcripts, and review AI-generated summaries and outcomes in real time.

View Details

23. IDverifyAI™ - Intelligent ID & Face Verification Platform

IDverifyAI™ is an AI-driven identity verification engine that scans national ID cards (front and back), passports, and residency IDs, automatically extracts all required data, crops the person's face from the document, and compares it with a live selfie video to verify the customer's identity — ideal for secure, fully digital customer onboarding.

View Details

24. DComAI™ - AI Document Comparison Platform

DComAI™ (AI Document Comparison) is an enterprise document-integrity platform that automates PDF comparison, signature verification, and tampering detection. It reduces manual review time, strengthens compliance, and provides organizations with faster, more reliable, and scalable document validation across high-volume operations.

View DetailsReal Estate Solutions

13. EAMS™ Escrow account and real estate off-plan sales management system

A platform managing off-plan real estate sales, rentals, and escrow accounts. It supports developers, projects, consulting offices, accountants, agents, and buyers, ensuring full governance, transparency, and compliance with off-plan sales processes.

View Details

19. RECM™ Real estate (RE) Claims Management between developers and the bank

A platform enabling real estate developers to claim payments for bank-financed units. Developers initiate claims through an internet portal, while bank staff validate, authorize, and process payments via a dedicated internal portal.

View DetailsOur Customers

Trusted by Leading Financial Institutions

BanKCube™ Services

Professional Services & Solutions

- All

- Data Services

- Solutions Services

- Other Services

Data Migration Services

End-to-end data migration services covering analysis, rules definition, mapping, extraction, transformation, and upload. We specialize in migrating from legacy to new core banking systems, ensuring data quality, compliance, and smooth transition.

Data Reconciliation Services

Structured reconciliation services comparing source and destination data during migrations. Using mapping sheets and business rules, it validates financial and non-financial data between legacy and core banking systems to ensure completeness and accuracy.

Business Data Mapping Services

A service providing complete documentation of data elements and meanings across core and other main systems. It enables consistent reporting, dashboards, and warehouse use, eliminating repeated mapping efforts by business teams.

Data Consolidation Services

Services to consolidate diverse data sources into a structured, unified database. This supports reporting, dashboards, data warehouses, and feeds, enabling consistent use of accurate, consolidated information across the bank.

Data Cleansing Services

When legacy data is missing or unusable, we work with business and IT to build clean data sets for migration. These sets become new sources to replace incomplete or untransferable legacy data.

System Implementation Management

We deliver banking solutions using project management best practices. A dedicated team ensures structured implementation, aligning project goals with business needs and achieving successful, timely delivery of banking technology initiatives.

Business Analysis and Solution Design

We perform business and technology requirements analysis, process reviews, and solution design. Deliverables include Business Requirements Documents (BRDs) and Functional Specification Documents (FSDs), developed in alignment with business and IT stakeholders.

Systems Integration Design and Implementation

We design system integration requirements, producing Integration Requirements Documents (IRDs). These include sample technical details, ensuring seamless connectivity between core banking and other systems, enabling secure, efficient, and reliable integrations.

B2B Portals Implementation

As part of B2B banking solutions, we implement external portals to engage third parties directly in processes. This ensures end-to-end automation, improves efficiency, and provides instant services to customers and partners.

Systems Implementation Consultancy

Upon customer request, we support existing system implementations by providing expert reviews and tailored recommendations for system enhancements, ensuring optimal performance, scalability, and alignment with evolving business requirements.

Secondment Services

We provide senior banking resources for specialized needs, including business analysts, project managers, infrastructure experts, and IT operations support, ensuring access to expertise for critical banking initiatives and ongoing operations.